What is happening to house prices, and could there be a crash?

House prices have fallen in recent months

House prices have been falling in recent months. That’s because higher interest rates have made mortgages more expensive, while rising prices have hit people’s spending power.

The Bank of England has raised interest rates over the last year from 0.1% to 2.25%, pushing up mortgage rates. At the same time, high inflation has driven up costs for households. This combination of higher mortgage rates and stretched budgets has cooled demand in the housing market.

What is happening to house prices around the UK?

Prices rose steeply – by about 25% – across most of the UK from the start of 2020 until Autumn 2022. But they have fallen by nearly 5% from their peak, according to July’s figures from the Nationwide Building Society.

The largest falls are in the South West and the smallest in Northern Ireland, Nationwide’s figures show.

These recent changes build on very different patterns of house price growth over the last 15 years. Northern Ireland’s prices have not returned to levels seen before the 2008 global financial crisis. In contrast, London and the South East saw prices recover quickly up until 2015. They then saw less growth during the pandemic, when many people relocated to cheaper areas in search of more space.

UK house prices fell sharply following the 2008 crash, bottoming out by mid 2009

House prices peaked in late 2007 before the 2008 financial crisis caused prices to fall nearly 20% from peak to trough. Prices bottomed out in mid-2009 and began recovering later that year once interest rates were slashed and the government introduced policies to support the housing market like the Help to Buy scheme.

However, the impact was uneven across the UK. Northern Ireland saw a much sharper crash, with prices falling 53% from peak to trough. London and the South East recovered more quickly while other regions like the North East saw slower price growth after 2009.

Is buying a home more affordable now?

Higher interest rates mean new mortgages are more expensive. Asking prices have not fallen far enough to balance this out. So, first-time buyers are unlikely to find buying a house more affordable in the short term.

In the longer run, if wages increase faster than house prices recover, housing will become more affordable. Those longer term trends also depend on whether housebuilding keeps up with demand.

Affordability is worst in the South of England where a first-time buyer could expect to spend more than half of their income on their mortgage payments. But in areas like the Midlands, it’s more like a third.

Will house prices crash?

In March, the Office for Budget Responsibility, which advises the government on the health of the economy, predicted that house prices will drop by 10% over the next two years.

That would be about half the fall of the financial crisis of 2008 and would put prices back to autumn 2021 levels. But predictions are very uncertain.

Some observers hope for a “soft landing”. That could mean interest rates nearing their peak now, small price falls in the rest of 2023 and then little, if any, growth next year.

An alternative view is that further sharp rises in interest rates could trigger even steeper falls in house prices in Autumn.

About 100,000 households come off a fixed-price mortgage each month. Even if rates stabilise, they will still be hit with interest rates that are higher than their last mortgage. Some may find their new monthly payments unaffordable, making them more likely to sell, possibly pushing prices down.

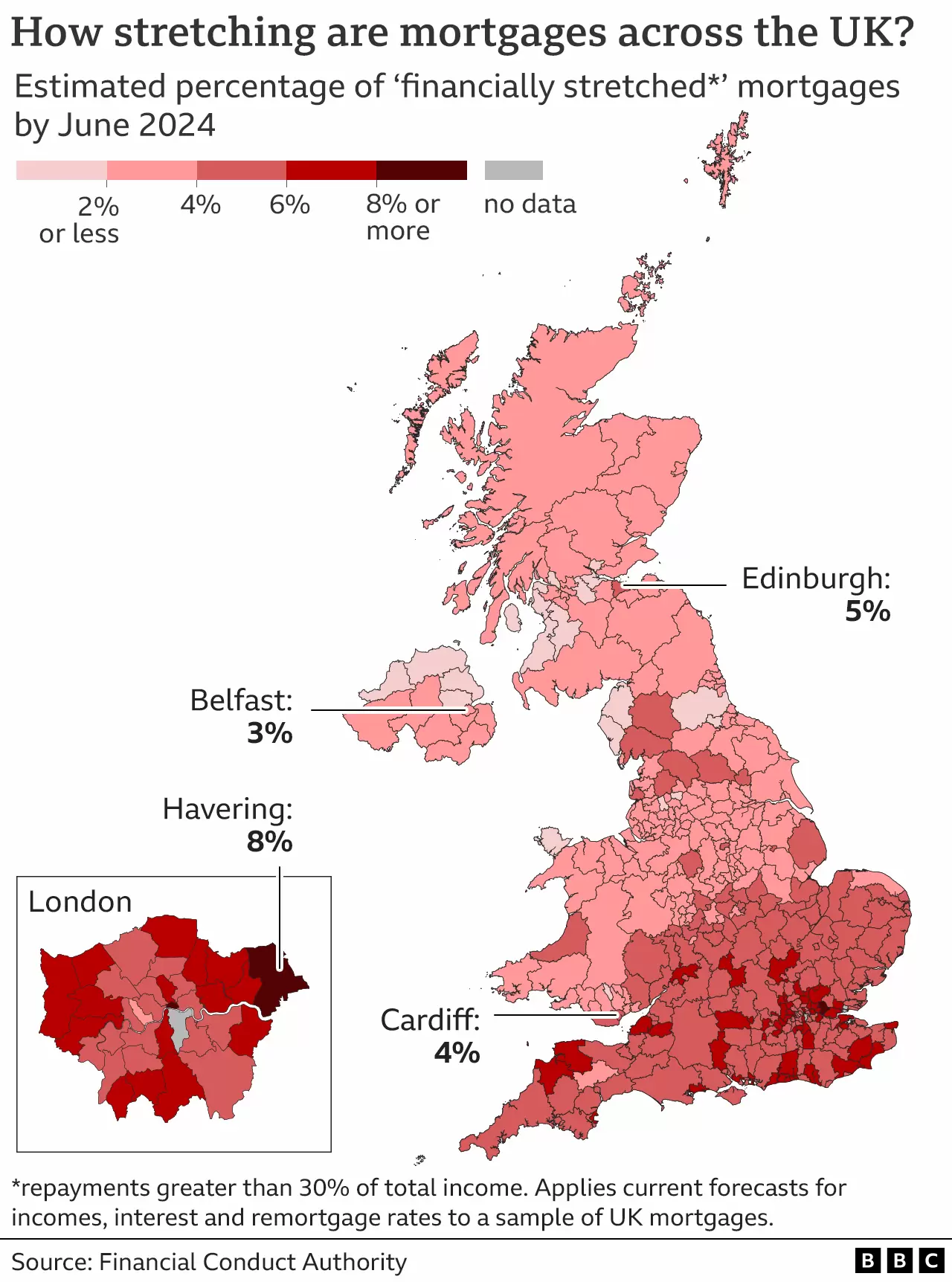

Are people struggling to pay their mortgage?

There are more people with potentially “financially stretching” mortgages in London and the South East than in the rest of the country, the Financial Conduct Authority says.

This is because loans in the south tend to be very high compared with borrowers’ incomes. The loans can become difficult to repay when mortgage rates rise, or inflation bites.

However, lending rules were tightened after the 2008 crash. Most borrowers in recent years have had their ability to pay checked against higher interest rates than those we’re currently seeing.

Fortunately, the number of people behind on their mortgages did not rise significantly in 2022 and was still at half the 2008 level. The number of repossessions in 2022 was also less than a tenth of what was seen in the years after the crash.

The amount people can spend of their mortgage also depends on wider cost-of-living pressures: on energy bills, wages and job security. And these factors can all change significantly.

The future depends on the wider economy

The future of house prices depends on the economy as a whole, and that picture is also uncertain.

If interest rates have to rise much further to control inflation, unemployment could also increase as the cost of borrowing hurts consumer spending and business investment. This could further dampen the housing market.

Alternatively, inflation could come down allowing interest rates to stabilise. This may only cause house prices to plateau rather than crash.

Overall, house prices are likely to continue falling for the rest of 2023 but a sharp crash is not guaranteed. A lot depends on how severe the impact of interest rates is on the UK economy.