The great stamp duty rip-off

Despite the recent changes to stamp duty that has offered a reduction in the rate for both first-time-buyers and home movers (albeit at a lower saving) in reality, things are not as they seem. Yes, the savings for a first-time-buyer may be as much as £6,750 for them, which will invariably swollen up by other costs, including higher mortgage payments and invariably higher prices being charged by developers, the reality of this fiscal disgrace is rather different.

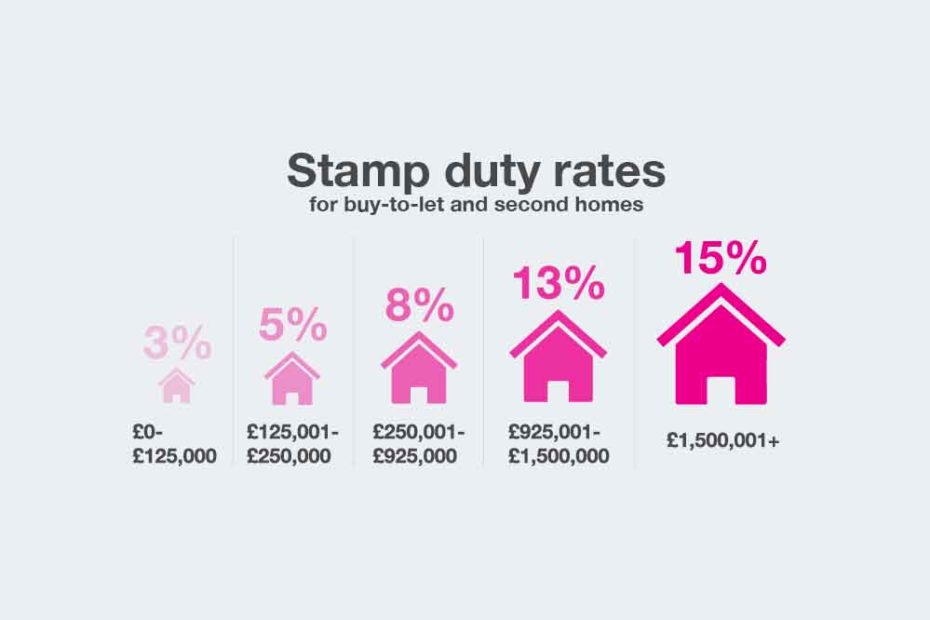

Landlords have to pay an additional 3% stamp duty for additional properties………..but not always!

At a time when Landlords are exiting the market en-mass, after being subjected to a campaign against them, including the implementation of an additional 3% Stamp Duty levy, that is forcing smaller Landlords out of the market, there is another development that has been happening quietly over the last few years.

Just as individual investors have been hit in every way possible, the corporations have been given a gift, because the higher stamp duty rate (the additional 3%) does not apply to those in a position to buy six or more properties at the same time!

What we are witnessing is the largest upwards shift in wealth in history. Whilst individual investors are being run out the BTL market, Lloyds Bank has been on a mission to become the largest Landlord in the UK by 2025.

This disparity in the stamp duty is not only having a serious effect on small Landlords, but it also affects small developers, who have to factor in an additional 3% stamp duty as part of their costs when they wish to renovate a property, invariably passing on the cost to buyers, if they can. Therefore, this is precious little encouragement for investors to improve or renovate the hundreds of thousands of properties in the UK, that are in dire need or improvement. The result being that many properties that could be brought in to the market for renters or first time buyers are being left empty or unfit for purpose.

What is UK Stamp Duty?

Stamp Duty Land Tax (SDLT) is a progressive tax usually paid when purchasing a residential property in England and Northern Ireland (there’s a separate Land & Buildings Transaction Tax that applies in Scotland and Wales).

When is Stamp Duty paid?

SDLT is payable to the HMRC 30 days from the date of completion or you may risk a fine. Your solicitor or legal adviser should take care of this for you and ensure you don’t miss the deadline. Some buyers prefer to add on the SDLT amount to their mortgage loan. A mortgage provider will be able to give you more details.

Who pays Stamp Duty?

SDLT is paid by everyone purchasing a residential or non-residential property in England and Northern Ireland, including overseas buyers, corporate bodies and non-natural persons.

The higher rate for additional properties applies if you already own a property overseas and different SDLT rates and thresholds apply to non-residential property or mixed-use land.

Is there any relief?

Multiple dwellings relief can be applied to “linked transactions”, which is where a buyer purchases more than one property as part of a single deal, arrangement or series of transactions between the same vendor and buyer (or persons connected with them). The SDLT under multiple dwellings relief is based on the average price paid per dwelling (as opposed to the calculating SDLT on the entire purchase price). For example:

- You buy 5 houses for £1 million

- £1 million divided by 5 gives an average of £200,000

- The amount of SDLT you pay on £200,000 at the higher rate for an additional property is £6,000 (i.e. 3% of £200,000)

- £6,000 multiplied by 5 is £30,000, which gives an effective SDLT rate of 3%

Alternatively, where six or more dwellings are purchased in a single transaction, then the buyer can choose to treat all the properties collectively as a non-residential transaction so that commercial SDLT rates apply. This can sometimes be more favourable than multiple dwellings relief.

Can I reduce Stamp Duty?

As SDLT is only payable on the land purchase, removable fixtures and fittings, or chattels, such as freestanding wardrobes, sofas, fridges, carpets and curtains, are not subject to SDLT and can, therefore, be subtracted from from the total property price. Everything ‘attached’ to property such as light switches technically form part of the property and are subject to SDLT.

If a seller is willing to leave certain chattels, you should agree to pay a reasonable amount between yourself and the vendor and subtract it from the agreed purchase price. Remember to seek advice from a tax lawyer or conveyancer.

Comment

As I have said previously, the solution is not a token gesture cut in stamp duty, but a fiscal structure to encourage investment where it is needed, which in this case, is the urgent improvement and renovation of the hundreds of thousands of properties that are unfit for use, as well as the enormous task of improving the energy efficiency of the oldest housing stock in the world. The current policies have done little to help those looking to rent to have access to more property as well as those wishing to buy their first home.

Instead, hard working people are being forced out and the banks along with large institutions are taking control at alarming rates……..this needs to change post haste!