Capital Gains Tax is Stealing the Wealth of the Nation

Britain’s Capital Gains Tax Challenge: A Relentless Assault on Investors

Introduction: The Taxation Turbulence

In the constantly shifting landscape of taxation, one tax has emerged as a formidable adversary for investors in Britain: capital gains tax. The government’s relentless pursuit of innovative revenue sources has unleashed a severe blow to property investors and landlords. With each passing year, the noose seems to tighten around the neck of capital gains allowances, leaving investors with a sense of impending financial doom.

Section 1: Slashing the Allowance

Chancellor Jeremy Hunt initiated the attack by drastically reducing the capital gains allowance from a comfortable £12,300 to a mere £6,000 at the beginning of the current tax year. Alarming as this may be, it is only set to worsen, dwindling to a paltry £3,000 by the approaching April. On the surface, it appears to be a blatant money-grab by the government, poised to cost property investors thousands of pounds when they decide to part with their homes.

Section 2: A Graver Situation

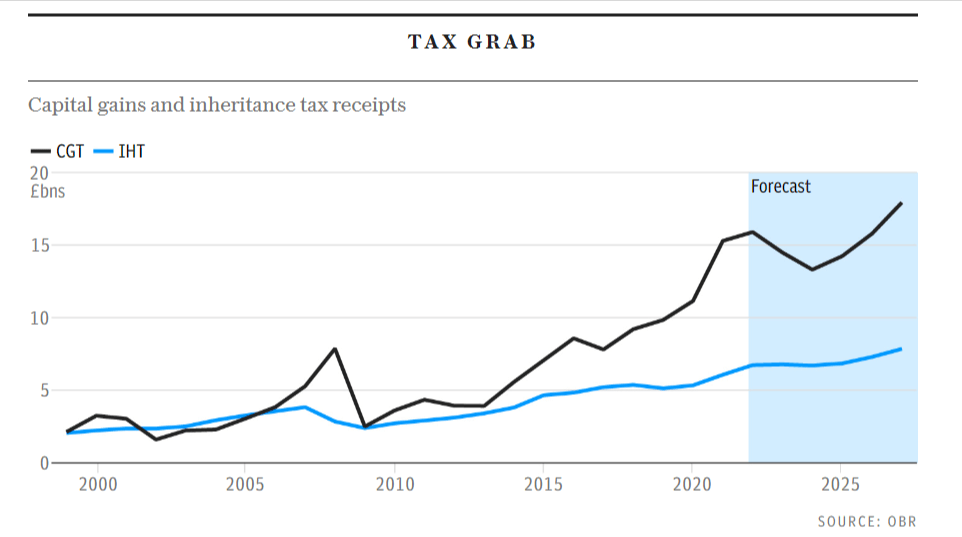

But the situation is far graver than a simple tax increase. This move coincided with a peak in property prices and government policies that are effectively compelling landlords to exit the market. In a disconcerting revelation, investment firm Fidelity International recently reported that capital gains tax revenue now exceeds that generated by inheritance tax by more than 2.5 times.

Section 3: A Taxation Transformation

Two decades ago, inheritance tax reaped £2.5 billion for the Treasury, while capital gains lagged behind at £2.3 billion. Fast forward to today, and the tables have dramatically turned. Inheritance tax raked in a substantial £7 billion in the last fiscal year, but capital gains surged ahead, amassing more than £18 billion. Moreover, the number of individuals subject to this tax has doubled in a mere decade, and with Mr. Hunt’s assault on the tax-free allowance, projections indicate it could soar to over £26 billion by 2028, according to the Office for Budget Responsibility.

Section 4: The Wide Taxation Net

Capital gains tax applies not only to property sales other than one’s primary residence but also to investments held outside tax-free wrappers like ISAs. Mr. Hunt has further compounded the financial squeeze by slashing the dividends allowance from £2,000 to £1,000, with plans to cut it further to a mere £500.

Section 5: The Tax Burden on All

While the burden of increasing income tax, exacerbated by stagnant thresholds and wage inflation, affects all taxpayers, the capital gains raid is a particularly severe blow to investors. This aggressive taxation campaign appears all the more cynical when juxtaposed with the government’s efforts to drive landlords out of the housing market through increased regulation and the gradual erosion of tax breaks on second homes.

Section 6: The Case for Abolishing Inheritance Tax

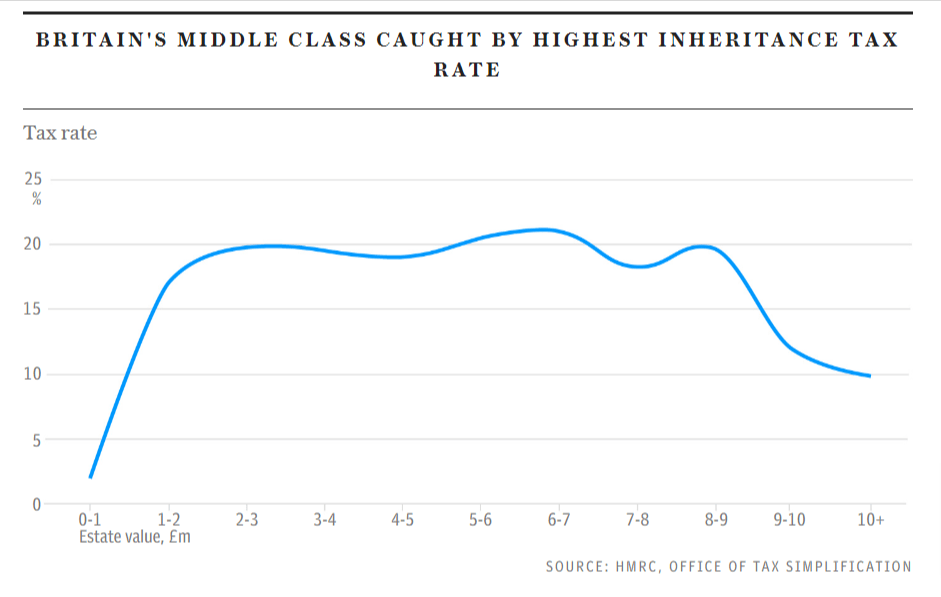

However, the surge in capital gains tax revenue only serves to underscore the urgency of abolishing inheritance tax. Telegraph Money has embarked on a campaign to eliminate this tax, which imposes a cruel penalty on bereaved families at their most vulnerable time. Beyond its cruelty, it is an inefficient and ineffective tax, with the wealthiest individuals able to exploit loopholes and avoid paying their fair share, while less affluent families find themselves ensnared in its web.

Section 7: The Need for Tax Reform

There is no justification for maintaining two major taxes on asset growth that now threaten virtually any middle-class family with even a modest accumulation of wealth. Savers are not exempt from this tax storm either. While interest rates may be on the rise, the personal savings allowance has remained unchanged since its introduction seven years ago, leaving higher-rate taxpayers who earn more than £500 in interest liable for tax on their cash savings outside an ISA.

Section 8: Uncertain Future of ISAs

Adding to the unease, rumors of an impending ISA overhaul are circulating, with the Treasury in discussions with stakeholders to encourage savers to invest rather than save. Influential policy think tanks have voiced concerns that the £20,000 annual savings limit primarily benefits the wealthy.

Conclusion: Navigating the Taxation Storm

For now, the sanctuary from this tax tempest remains the ISA, but in an era of evolving taxation, how long can this last? It would be unwise to underestimate the government’s ability to devise new ways to tap into the resources of savers and investors. As the storm gathers strength, investors, savers, and property owners must remain vigilant and adaptable in navigating the complex and ever-changing landscape of taxation in Britain.